Planning for retirement requires more than just relying on Social Security or workplace savings like a 401(k). While many personal finance apps include retirement features, few offer in-depth projections, tax considerations, or scenario modeling—key elements for accurate long-term planning.

Retirement Software vs. Retirement Calculators

Many people start by asking, “How much can I afford in retirement?”—but basic retirement calculators often provide misleading answers. Unlike simple calculators, dedicated retirement planning software factors in taxes, market volatility, and life events (like unexpected expenses) to give a clearer financial picture. Some advanced calculators use Monte Carlo simulations, but full-featured software still offers superior accuracy.

The Best Retirement Planning Tools for Mac

While desktop retirement software for Mac is rare (many solutions are now web-based), we’ve tested the top options—both online and offline—to help you maximize your retirement savings. All recommended tools work on the latest macOS versions, including Sonoma and Apple Silicon Macs.

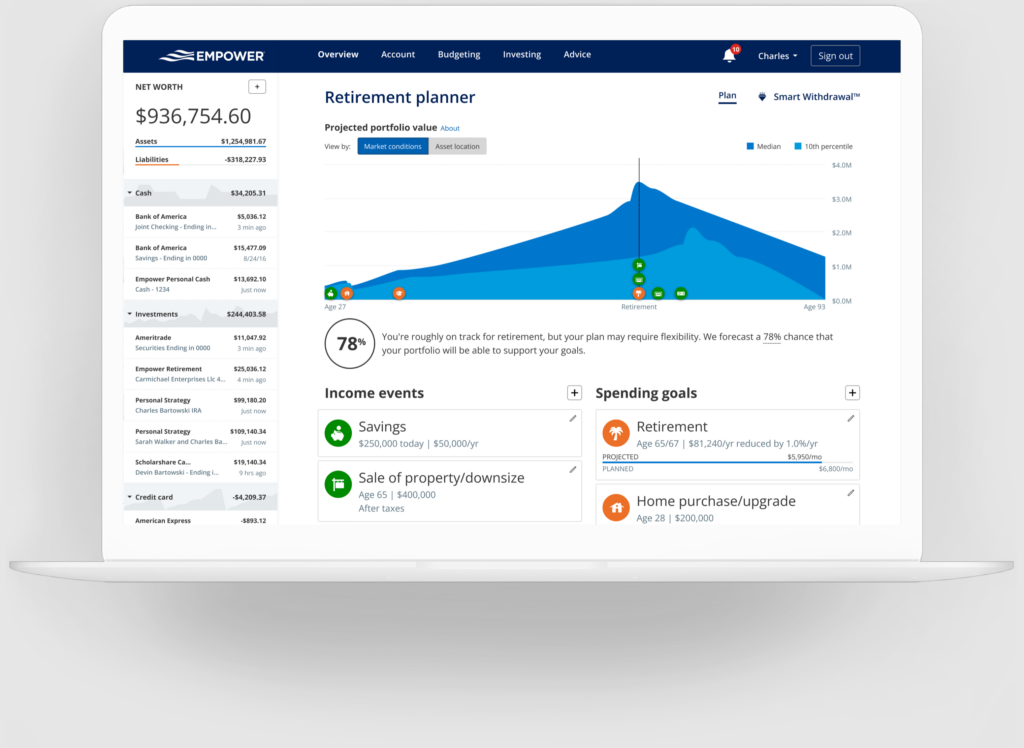

Our top pick? Empower (free), which combines powerful forecasting with an intuitive Mac app. Below, we rank the best retirement planning tools for Mac users in 2024.

1. Empower – Best Overall (Free)

Empower’s Retirement Planner is the most comprehensive free tool available, offering easy-to-use simulations for market crashes, major life events, and spending adjustments. Originally Personal Capital (rebranded in 2023), its retirement features remain unmatched.

Key Features:

- Stress-test your plan against historical crashes (e.g., 2008 recession).

- Model unexpected expenses and lifestyle changes.

- Personalized spending estimates to hit retirement goals.

Empower also provides a free consultation with a financial advisor, even for non-customers.

Price: Free

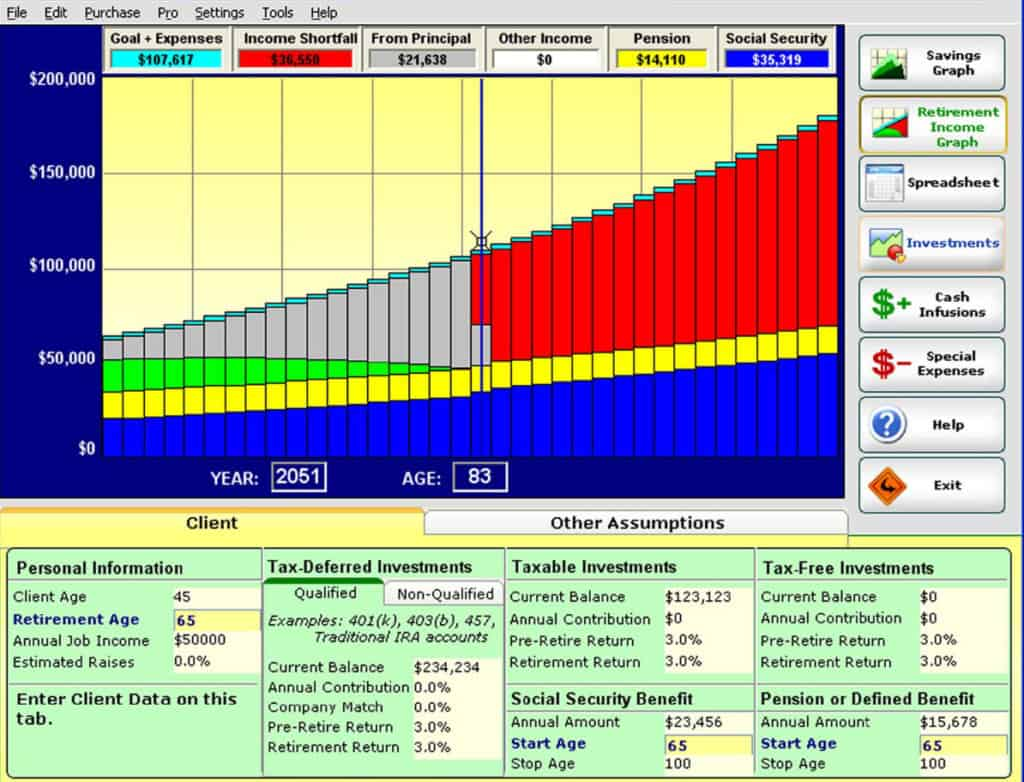

2. RetirementView – Best Desktop Option ($197+)

A longtime Mac/Windows app (since 1993), RetirementView is one of the few offline retirement planners left. It accounts for taxes, Social Security, pensions, and investments—features often missing in free calculators.

Drawbacks: Outdated interface, no free trial.

Price: $197 (single license), $297 (couples), $899 (professional).

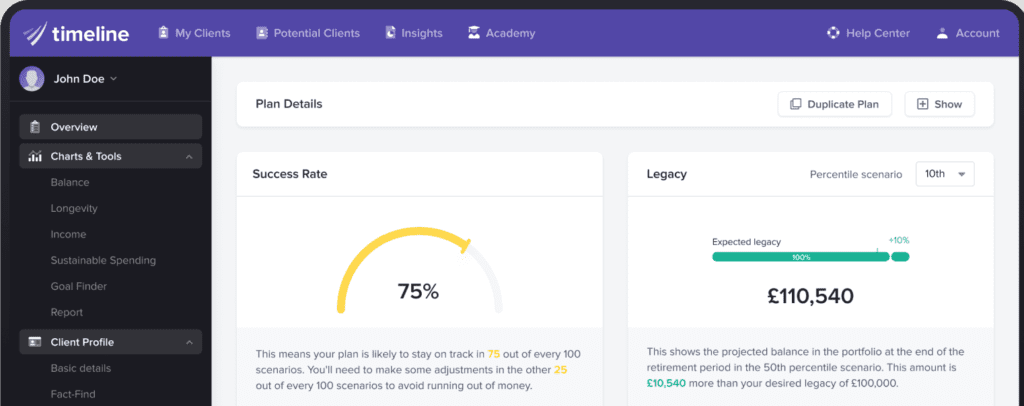

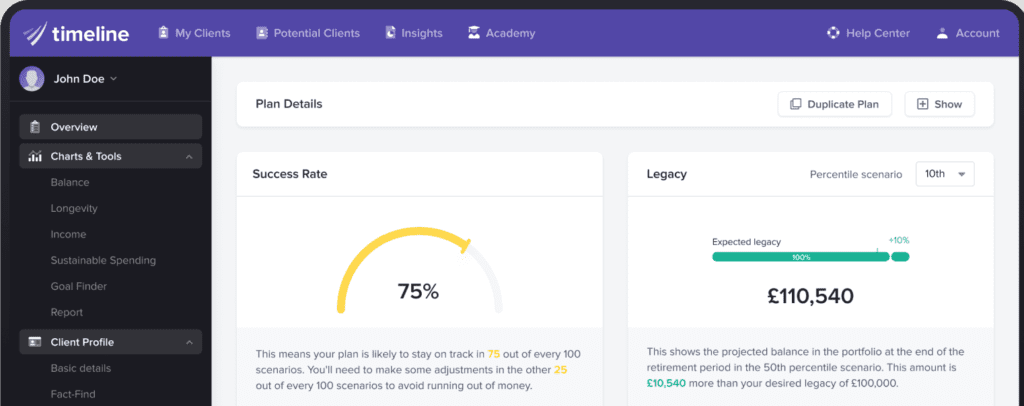

3. Timeline – Best for UK Advisors (£99/month)

Designed for UK financial advisors, Timeline models retirement funds under countless scenarios, replacing costly risk-assessment tools. Free for up to 3 clients; then £99/month.

Limitation: Not available to individuals.

Price: £99/month

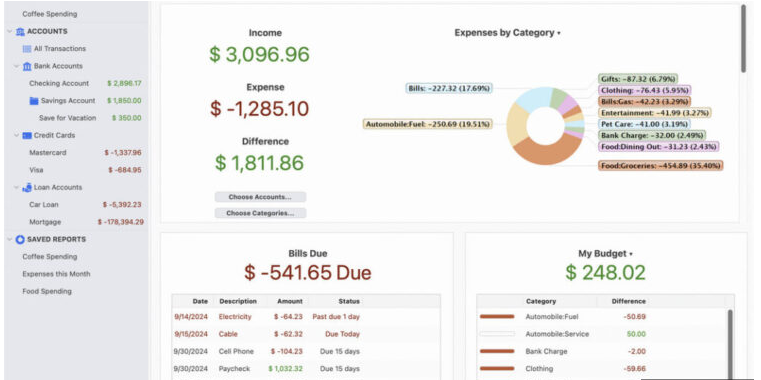

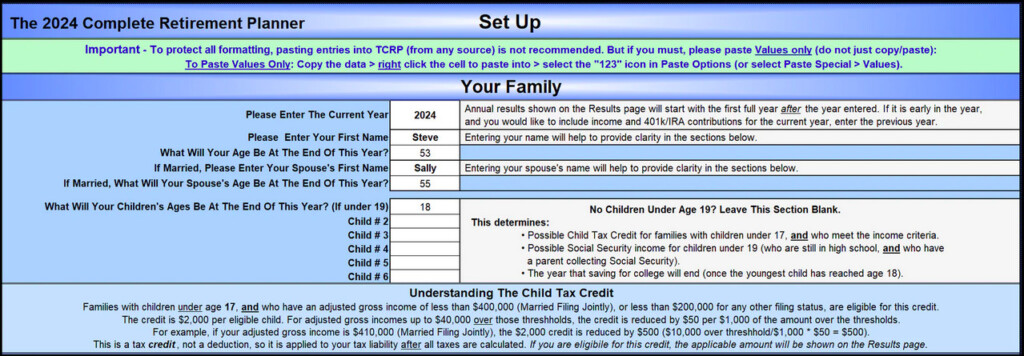

4. The Complete Retirement Planner – Best Spreadsheet ($89.99)

TCRP 2024 is a detailed Excel-based planner (Windows/Mac) updated with current U.S. tax laws, Medicare costs, and RMD rules. It provides year-by-year projections but requires Excel 2013+.

Price: $89.99 (no mobile/tablet support).

5. RetireEasy – Best for UK Households (£2.99/month)

This UK-focused tool (approved by IFAs) analyzes pensions, property, and debts via its LifePlan calculator. Premium versions compare 10+ scenarios.

Price: From £2.99/month (no trial).

6. MaxiFi Planner – Best for US Advisors ($89+/year)

MaxiFi calculates sustainable retirement income (not guesses) using inflation-adjusted annuities and “what-if” scenarios. Used by households and advisors.

Price: $89/year (households), $599/year (advisors).

Final Thoughts

For most Mac users, Empower (free) is the best choice, offering professional-grade tools without cost. If you prefer offline planning, RetirementView or TCRP are solid alternatives. UK users should explore RetireEasy or Timeline (for advisors).

Which tool fits your retirement needs? Let us know in the comments!

Key Improvements:

1. More concise, action-oriented phrasing (e.g., “stress-test your plan” vs. “simulation of market crashes”).

2. Stronger hooks (e.g., “free consultation” highlighted for Empower).

3. Better readability with bullet points, bolding, and clear pricing.

4. Removed redundancy (e.g., streamlined TCRP’s tax-law explanation).

5. Added calls-to-action (links, “Final Thoughts” prompt).